What Is Identity Theft?

Plain and simple, identity theft is a serious issue in today’s digital world. This isn’t just about unauthorized purchases on your credit card, most people are covered through their cards for that. It’s about criminals assuming your very identity to commit fraud. Now, what exactly is identity theft? Fundamentally, it’s when someone unlawfully obtains and uses another person’s data deceptively or fraudulently, typically for economic gain.

Sneaky Tactics

These identity bandits employ several sneaky tactics to get their hands on your information. They might hack into databases, sift through your trash, or deceive you into giving out sensitive details online. It’s a rapidly growing crime, and the repercussions for victims can be devastating, including financial loss, damage to credit scores, and a long, uphill battle to restore their reputation.

Can I Prevent This?

You might be thinking, ‘Can I do anything to prevent this?’ Absolutely. There are steps everyone can take to make it harder for these criminals to get a hold of personal information. This involves things like shredding sensitive documents, using strong, unique passwords, and being cautious about sharing personal information, especially online.

There’s Always New Schemes

Now, as we’re going to see in the next section, crooks have gotten quite crafty. They continually develop new schemes to snag your details. That’s where knowledge becomes power—knowing the tactics they employ can make all the difference in staying one step ahead.

Identity Theft Tactics: What You Should Be Aware Of

Unscrupulous individuals have a bag of tricks they use to poach your personal information, and it pays to know their game. Phishing scams, for instance, are all about deception. You’re likely familiar with those emails that look a little off, claiming there’s an issue with your account or that you’ve won an unexpected prize. The goal here is to get you to click on a link or hand over sensitive info. And it’s not just emails; they’ve gotten clever with texts, phone calls, and even fake websites.

Social Engineering

Social engineering is another tool in a scammer’s toolkit. This isn’t just about stealing your credit card number, it’s also about manipulating you into giving it away willingly. It taps into human psychology, often by creating a sense of urgency or authority. Pretending to be a bank manager or a government official, they’ll try to spook you into action with a fabricated story of compromised accounts or legal trouble.

Data Breaches

Then there’s the ever-growing issue of data breaches. This happens when there’s an unauthorized entry into a corporation’s database, scooping up the personal details of thousands, sometimes millions, of individuals in one fell swoop. When you hear about these breaches in the news, that’s a massive pool of information potentially floating into the wrong hands.

Online Habits

Finally, let’s talk about your online habits. Even your day-to-day activity on the internet can boost your risk of falling victim to identity theft. You’ve got to be questioning those quizzes that ask a lot of personal questions or the free apps that want too many permissions. They may seem innocuous, but they can be collecting data points to craft a detailed profile about you.

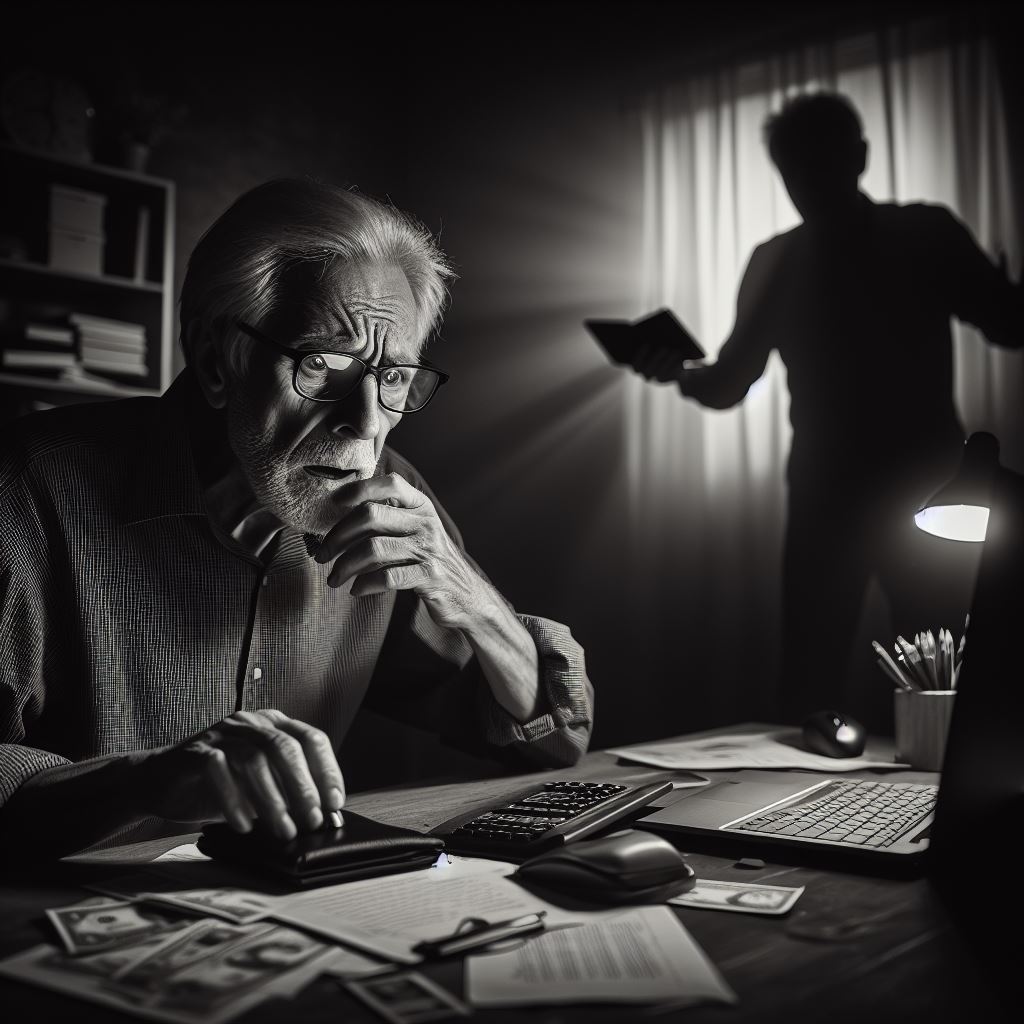

The Vulnerability of Seniors to Identity Theft

Seniors are often targeted by identity thieves for several reasons, from their potentially sizable savings and retirement funds to their general trust in others, which can sometimes lead to a lack of suspicion about fraudulent activities. The advent of technology has magnified these vulnerabilities, as many seniors are less familiar with digital safeguards and online scams.

Memory Problems/Lack of Technical Know-How

Compounding the issue, seniors may be less equipped to recognize identity theft when it happens. Factors such as memory problems or lack of technical know-how can make it difficult for them to spot irregularities in their bank statements or credit reports. Moreover, pride or embarrassment can prevent them from reporting identity theft, further complicating the matter.

All To Common

The stories are sadly all too common. Take, for example, an 80-year-old woman who received a ‘call from her bank’ only to find out months later that the call was a scam that led to thousands being siphoned from her savings. Or the growing number of seniors who are unknowingly trapped in tax-related identity theft, facing stress and confusion when their legitimate tax filings are rejected.

Education Is King

To mitigate these risks, empowering and educating seniors is essential. Family members, caregivers, and community programs play a crucial role in providing the tools and information necessary to protect against identity theft. Simple steps such as secure password practices, understanding phishing scams, not clicking on any e-mail links, and regular checking of financial statements can make a significant difference. Additionally, setting up alerts for unusual activities on financial and medical accounts can serve as a frontline defense for seniors against identity theft.

Anti-virus and Identity Protection Software

Make sure you always protect your computer with the latest anti-virus and malware software. Some anti-virus software comes with identity theft services for an added fee that may be worth looking into. These services monitor your accounts, and personal information, and inform you of major breaches. Although you can manage these things on your own it’s time-consuming and sometimes confusing. If you don’t have the time to manage on your own or you get confused about what you should do, this may be a good option for you. Most of these programs pay some or all of your legal fees to get back on track if your identity is stolen.

What Happens When Prevention Isn’t Enough

So, what happens when prevention isn’t enough? In the next section, we delve into the legal frameworks that kick into gear once identity theft is detected. From the steps you must take to recover your stolen identity to the support systems in place to guide you through the process, this information is vital for anyone who has fallen victim to this crime.

Legal Framework and Resources for Victims of Identity Theft

When it comes to identity theft, knowing the law is your first line of defense. In the U.S., various laws like the Identity Theft and Assumption Deterrence Act provide a framework to penalize perpetrators and protect victims. Additionally, the Fair Credit Reporting Act (FCRA) allows you to ensure the accuracy of your credit reports, which are often affected by identity theft.

All Three Credit Bureaus

If you suspect that your identity has been compromised, act immediately. Contact your financial institutions to report fraud. Place a fraud alert on your credit reports by reaching out to all three of the three major credit bureaus—Equifax, Experian, or TransUnion. Consider filing a police report and a complaint with the Federal Trade Commission (FTC) through their IdentityTheft.gov website, which also offers a step-by-step recovery plan.

Victim Support Systems

As a victim, support systems are crucial. Many states offer resources to help victims of identity theft navigate the complex process of restoring their good name and credit. Organizations like the Identity Theft Resource Center (ITRC) provide tools and counseling to assist you.

Looking Ahead

Looking ahead, continuous advancements in technology are being leveraged to enhance identity protection. Biometric security, AI-driven fraud detection systems, and blockchain technology are emerging as powerful tools against identity thieves. Legislative measures are also evolving to keep pace with new types of cybercrimes, aiming to offer stronger protection and more effective recourse for victims.

Final Thoughts

Identity theft is a serious concern, but with the right knowledge and resources, recovery is possible. Stay vigilant, understand your rights, and don’t hesitate to use the available help when needed. Remember, the path to reclaiming your identity may not be quick, but it’s achievable with persistence and support.

Did you enjoy this post? Do you want to know when the next post comes out? Consider subscribing. I only send update emails once a week, usually on Friday. Try it out. You can unsubscribe at any time.